THE JULY 15TH EXTENSION DEADLINE IS APPROACHING!

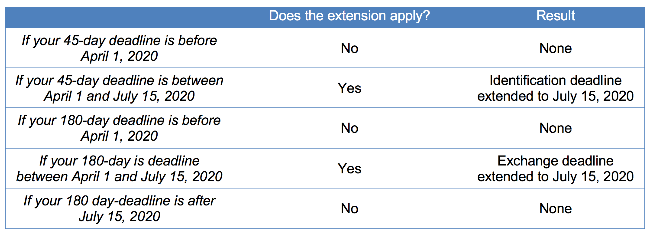

Earlier this year, the IRS issued guidance extending the time periods for individuals currently in a 1031 Exchange due to the Coronavirus pandemic. IRS Notice 2020-23 provides that those performing time-sensitive actions listed in Revenue Procedure 2018-58 due to be performed on or after April 1 and before July 15, 2020 is an Affected Taxpayer.

It appears Exchangors whose 45-day identification period or 180-day exchange period falls between April 1, 2020 and July 15,2020 will have until July 15 to identify and/or purchase a replacement property for 1031 exchanges.

July 15th is less than two weeks away.

To find out if a 1031 exchange is right for you, please give us a call and we will be happy to answer any questions you or your clients may have as they relate to your situation. We can be reached at 1-800-735-1031 or 1031exchange.com now!

Practice Tips

This is an optional extension, an Exchangor is not required to extend their exchange timelines.

Example: John closed his relinquished property on April 1, 2020 but then decides he does not want to move forward with the exchange. If John does not identify any replacement properties he may cancel the exchange and receive the 1031 funds after the initial 45-day identification deadline of May 16, 2020.

If an Exchangor’s 45-day identification period is extended to July 15th, the 180th day of the exchange is not also extended beyond the initial 180-day deadline.

Example: John closed his relinquished property on March 1, 2020. His 45-day identification date is April 15, 2020. Because of the extension, John has until July 15, 2020 to identify replacement property. The 180th day of John’s exchange is August 28, 2020, this date is not extended.

If an Exchangor’s 180-day deadline is extended to July 15, the initial 45-day identification deadline is not impacted. The Exchangor must close on an identified property to complete the exchange.

Example: John closed his relinquished property on December 15, 2019. His 45-day identification date is January 29, 2020. John’s 180-day deadline is June 12, 2020. John has until July 15, 2020 to complete his exchange but must close on a property identified within his initial 45-day identification period. John cannot change identified properties as the 45-day identification deadline was before April 1, 2020.

MORE INFORMATION

The Equity Advantage Incorporated Channels

Head to our channel and watch as owner of Equity Advantage David Moore speaks on 1031 Exchanges and other issues concerning commercial real estate in today’s unique market.

REITs, TICs, & DSTs – What They Are and Why Invest In One Today

Self-Directed IRAs and Disqualified Parties

Visit our Video Library for more videos!

The Guys With All The Answers…

David and Thomas Moore, the co-founders of Equity Advantage & IRA Advantage

David and Thomas Moore, the co-founders of Equity Advantage & IRA Advantage

Whether working through a 1031 Exchange with Equity Advantage, acquiring real estate with an IRA through IRA Advantage or listing investment property through our Post 1031 property listing site we are here to help Investors get where they want to be. About Us…