Join us at the next Oregon SW/Washington CCIM Chapter event as a member or non-member when we hear from Jonathan McGuire with Aldrich CPAs + Advisors about the latest tax changes!

Topics Covered are:

- Federal Changes: What COVID relief has changed and what benefits still exist.

- Oregon: An update on the commercial activity tax.

- Local Taxes: A penny here, a penny there, real dollars everywhere.

Speaker

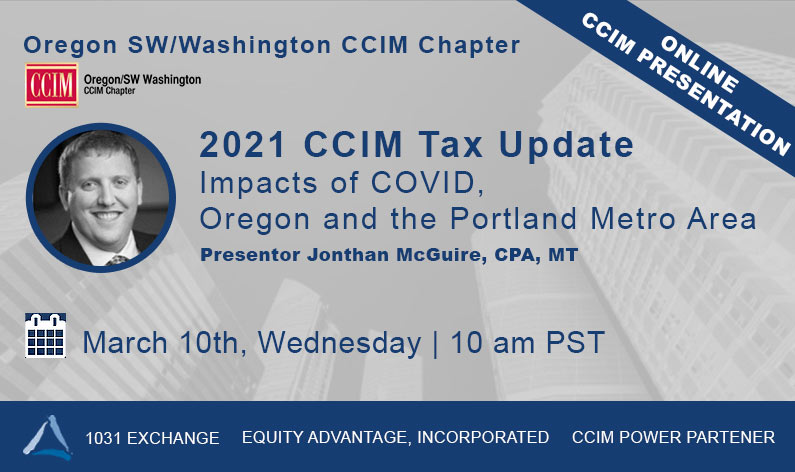

Jonathan McGuire, CPA, MT

Senior Tax Manager – Real Estate

Aldrich CPAs + Advisors

2021 CCIM Tax Update Impacts of COVID, Oregon, and the Portland Metro Area

Wednesday March 10, 2021 10:00 – 11:15 am PST

March Oregon Continuing Education Course

1 Oregon CE Credit available

Non-members get CE credit when they pay the $15 non-member CE credit fee when registering.

Attendees must be on the call live to get the credit.

Please register for the webinar here

Sign up to receive our newsletters

View our other webinars on 1031 Exchange topics on the Equity Advantage YouTube channel: