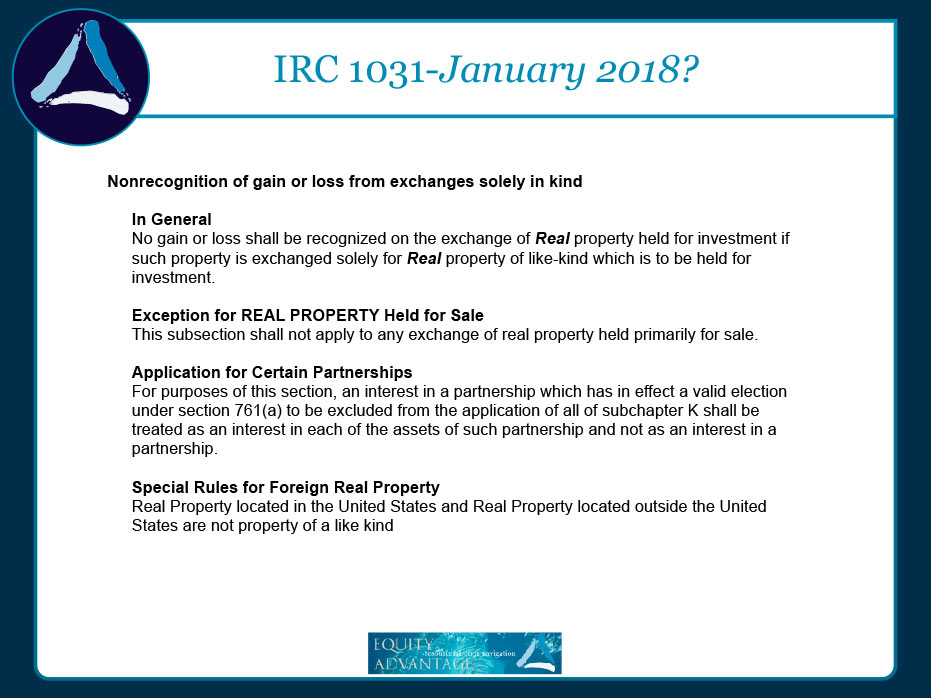

David Moore, 1031 Exchange facilitator with Equity Advantage Incorporated (1031Exchange.com) speaks on whats to come with IRC 1031 Exchange options leading into 2018! Including exceptions for REAL property, and how the new changes are applied to certain partnerships.

IRC 1031 January 2018

Watch, Listen or Read:

Transcript

If you look at what they’ve done now, we’ve got a change from just property to REAL property. When you look at what it says, they change everything from property to real property. They’re wanting to tighten up a little bit about defining stuff held for resale.

So, for example, the woman in the back with the development company. Even if you’re a developer and a dealer, you can have investment property and you can have dealer property. It has to do with intent in a lot of these situations. How do you prove intent?

I’ve actually had people put in a purchase sale agreement, that when they’re buying it, it’s their intent to hold this thing for investment, which I think is sort of funny. Understand that time is not the issue, it is intent.

Think about your clients if you’re a real estate broker. Have you purchased anything for anyone recently and then a month, two months, six months later they get an unsolicited offer that’s too good to pass up if somebody approaches them?

We have these transactions in a market like we have today where you buy something, and then somebody makes you a great offer. You can do it once, but you can’t get too lucky too often. It’s really important that we don’t establish a pattern there that would indicate you’re holding things for resale instead of investment.

But they actually are helping us with respect to partnerships. For example, Oregon is not a community property state. Imagine, you have some rental houses and you go out and meet with your lawyer, and your lawyer says, “Hey, you know what, you ought to own all your rental houses in a limited liability company.” I’ve got people that will have a pool of properties with no LLC. I’ve got people that will have an LLC for all their properties. And I’ve got people that will have a separate LLC for every property. It’s really just comfort…

Class question:

What do you recommend?

David Moore’s Answer:

It’s really … if you’re going to go buy a gas station, you better have an LLC, and I’d say have that one LLC alone. But, it’s also a combination of the LLC and your insurance. Look at the asset and the liability. The way things are going with tenant rights, it might make sense to have a different LLC with each property.

The problem is that it gets tough. Think of this, you’ve got a rental house… number one, can you finance that property in the LLC’s name? Probably not. You can if you go to a portfolio lender, but if you go through traditional Freddie, Fannie channels, you’re not going to.

Class question:

Or, you could get it at really good interest, right?

David Moore’s Answer:

Exactly. But, what does your mortgage broker say a lot of times, “Oh, just buy it personally and then deed it in the LLC.” Have you ever heard that? Okay. So, if you read the fine print alone, what does it say about change like that?

Class comment

Due on sale.

David Moore’s Answer:

Due on sale. What’s ironic to me is you look at a big property and what’s the bank want? The bank might require a Limited Liability Company. Typically, that LLC is not going to remove that buyer’s obligation to pay, it’s just going to protect him. I would think if the lender really understood what was going on with the LLC’s, they would require an LLC. And they might require a different LLC for each asset.

We’re doing a deal in Idaho right now. It’s $35 million, for three properties. And in this case they are requiring each property to be held by a different LLC. In that transaction, we’ve got two clients coming in from a couple different sources. They are partners in one, and they’ve got a couple other assets coming into the transaction. We are having to figure out how many, so each of those properties is going to be owned, tenancy in common by a series of Limited Liability Companies. And each one has to be new per the bank and it’s single numbers.

We’re doing this because we’re going to be creating ownership in all these different individual assets and we’ll be doing assignment of membership interests in those respective properties in the future because the member of some of these LLC’s is another Limited Liability Company. We’re just shoveling things around over time after we’ve acquired the property.

Historically what happens, back to my comment, is a husband and wife put the property into an LLC, they go to relinquish that property, and we have to have continuity investing so we got an Exchange agreement for the LLC moving forward. Now what happens? They talk to the lender, the interest rate is higher, and now they’re upset. They want to take ownership individually, and the lender says take ownership individually to then put it into the LLC. But we can’t do that because we’re not a community property state. California or Washington should be going this way. So, we can go in now as an LLC in those states, but we can’t in Oregon.

That’s how easily it gets to be a problem.

Class question:

Here’s something else, you can re-title?

David Moore’s Answer:

Yeah, you can, but yeah-

Class comment:

Re-title the property from your personal then. Refinance it personally and then if you want to do the switch and roll the dice.

David Moore’s Answer:

Historically, Ken is right. Historically what happens is we do what’s called a drop and swap, or swap and drop. We have to break the entity and then have deeds drawn back and forth. When do you think that happens? When the deal is in escrow, because even if we met a year in advance, if we own this property and we said, okay, a year from now we’re going to sell the property, we all own a membership interest in the asset. We don’t actually own the asset. A year ago, we could have had a meeting with all our tax and legal people and agreed we’re going to change that to a tenancy in common. But, then we’ve got lease agreements, tax returns, loans, and all these other things that have to be done. You can’t just change the title and say it’s done. You’ve got to actually change it, and it doesn’t happen because it’s expensive, and time consuming. People just don’t want to worry about it.

What happens is, we will have left this meeting a year ago and I get a call the deal is in escrow. I get a copy of the title report though and it didn’t happen. I ask, and sure enough it wasn’t done because of xyz..

Inevitably it happens in escrow. So, we amend the purchase sale agreement, have escrow draw a deed from that LLC to the individuals, and we go out. The problem with that is, did we personally own the property for investment, or hold it for investment prior to disposing of the property? It would be hard to argue that we did successfully.

Some states, like California have been chasing those, and tax reform may actually have looked at it. Hopefully if it goes through, they clean it up. If you’re filing as a tax pass through, then they are looking at it and saying, hey, you might be in this LLC but you actually own the assets of the LLC instead of the membership interest.

If it all goes through, that’s something that I’m very excited to have them clean up a little bit, and simplify. It’s just one of those things where we deal with it day in and day out because even the spouses going in and out of the properties creates problems. If it can get done that way, I’ll be a happy guy and then we’ll have a learning curve until the tax and legal community get things taken care of.

That’s really what they’ve done to the 1031. For the most part… I’m going to miss being able to do the cars. planes and my favorite, the boats. There just fun to be able to talk about and do some different things. But, to keep it intact, the way it works with real properties, is obviously a great thing for everyone.

Think about if it went away and you had tax exposure. What would that do to the market velocity? What would it do to things? I’ve got concerns with the interest deductions and the state and local tax deal. I’m not a fan of either one of those things with what they’re doing. Look at the price of real estate today in our region and what’s happening with it.

We’ll see how it all boils out when it actually happens. It looks like they’ve done good things with 1031 except for that personal property piece, which obviously is not very good. But, I’m happy to have the real estate taken care of.